Fact check: New Jersey's "tax burden"

January 7, 2016

By Charles Aull

A recent television ad from a super PAC supporting Marco Rubio (R) took aim at Chris Christie’s (R) record as governor of New Jersey. The ad makes a number of claims, but one that caught our eye states, “New Jersey has the nation’s highest tax burden.” We wondered, first, what does “tax burden” mean and, second, is New Jersey’s really the highest?

Tax burden, or more precisely, “taxpayer burden,” as we discuss below, actually doesn’t have all that much to do with taxes, at least not directly. Instead, it’s more related to debt. Taxpayer burden is a complicated accounting term that reflects a state’s available assets vs. a state’s total bills. The difference between those numbers—when negative—is a taxpayer burden. According to a study from the nonprofit Truth in Accounting (TIA), New Jersey does indeed have the highest taxpayer burden in the country.

Background

Chris Christie became the governor of New Jersey in January 2010 after serving eight years as the U.S. Attorney for the District of New Jersey. He declared his candidacy for the Republican nomination for the presidency in June 2015.

A super PAC called Conservative Solutions PAC, which is backing first-term Senator Marco Rubio, released a television ad on January 4 focused on Christie’s record as governor. The ad, titled “Look at me,” criticizes Christie on a number of different points. It states that most New Jerseyans are looking to leave the state, that New Jersey’s job growth is among the lowest in the country and that two of Christie’s aids are currently under criminal indictments. About midway through the ad, the narrator claims, “New Jersey has the nation’s highest tax burden.” The ad closes with a black-and-white image of Christie as the narrator states, “Chris Christie. High taxes. Weak economy. Scandal.”[1]

New Jersey’s “taxpayer burden”

In the ad, Conservative Solutions cited an Associated Press article from September 21, 2015, as its source for the claim about New Jersey’s tax burden. That article, in turn, cited a study from the nonprofit Truth in Accounting (TIA) titled “Financial State of the States.”[2] This is an annual study that TIA has been conducting every year since 2009. It ranks states based on what TIA calls a “taxpayer burden,” a term that reflects the amount of state debt for which taxpayers are on the line. The study itself notes that the term represents “the amount each taxpayer would have to send to their state’s treasury in order for the state to be debt free.”[3] Bill Bergman, the director of research at TIA, explained to us via email, “‘Taxpayer Burden’ is our bottom-line measure of state and local government financial condition. It is a balance-sheet perspective, not an income statement or cash flow measure.”[4]

To figure a state’s taxpayer burden, Bergman said that TIA begins by looking at a state’s total reported assets minus capital assets and assets restricted by law (buildings, roads, land, etc.). This number constitutes what TIA calls “available assets.” Next, they figure out a state’s total bills, which includes retirement obligations such as pension plans and healthcare benefits for retirees but does not include debt from capital assets. If the difference between available assets and total bills is positive, TIA calls this a taxpayer surplus; but, if it’s negative, this is called a taxpayer burden. The final step is to take that surplus or burden and divide it by the number of taxpayers in the state. Bergman told us taxpayers in this context means those with “individual tax returns with a positive tax liability.”[4]

That final step is where the rankings come in. According to TIA’s method of calculation, New Jersey’s taxpayer burden was $52,300 per taxpayer in 2014. This is more than any other state. The second highest was Connecticut with $48,600 per taxpayer. The charts below show the top five highest taxpayer burdens and surpluses in the country.[3]

| Top five states with the highest taxpayer burdens, 2014 | |

|---|---|

| State | Taxpayer burden |

| New Jersey | $52,300 |

| Connecticut | $48,600 |

| Illinois | $45,000 |

| Kentucky | $32,600 |

| Massachusetts | $27,400 |

| Top 5 states with the highest taxpayer surpluses, 2014 | |

| State | Taxpayer surplus |

| Alaska | $52,300 |

| North Dakota | $28,400 |

| Wyoming | $22,600 |

| Utah | $4,200 |

| South Dakota | $4,000 |

| Source: Truth in Accounting, "Financial State of the States, 2014" | |

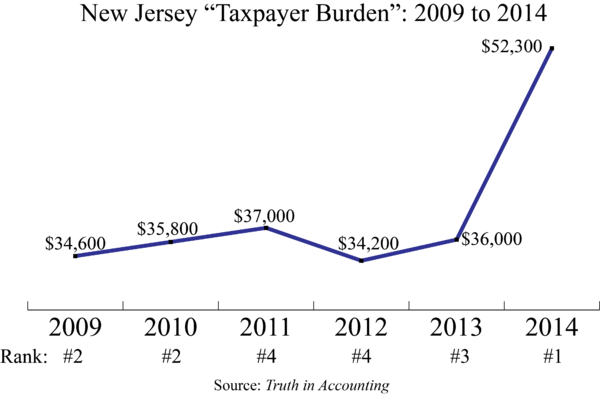

We also looked at past “Financial State of the States” reports to see how New Jersey’s taxpayer burden has fared since 2009, the year TIA began publishing its study. The chart below shows New Jersey’s rankings between 2009 and 2014 as well as the amount of its taxpayer burden each year.[5] Note, however, that the jump from 2013 to 2014 is primarily due to a change in accounting standards. This is discussed in more detail below.

It should be pointed out that the results of TIA's “Financial State of the States” study differ from those of another annual state debt study by the nonprofit State Budget Solutions (SBS). In its most recent "Annual State Debt Report," which was published in 2014 but focuses on data from 2012, SBS ranked New Jersey sixth in the nation for its level of debt. One of the core differences between SBS's and TIA's approaches is that SBS measures debt on a per capita basis, while TIA measures on the basis of the number of annual tax filings with positive tax liabilities.[6]

Lingering questions

After going through this data, we still had some lingering questions. First, why is New Jersey’s taxpayer burden so high? Shawn Cruce, a researcher at TIA told us that this has a lot to do with unfunded pensions. “New Jersey's taxpayer burden is so high because their retirement obligations, especially pensions, are largely unfunded. Their unfunded pension benefits stood at $85 billion at the end of the 2014 fiscal year, and their other post-employment benefits were at $55 billion. We calculated their total bills to be about $185.6 billion. If you look at our taxpayer burden measure for NJ for the last few years, you'll notice that it jumped from the mid $30,000s to $52,300 in just one year.”

That jump, according to Cruce, was largely due to a change in accounting standards implemented by the Governmental Accounting Standards Board or GASB. “GASB Statement No. 67, the new standard, required many pension plans and reporting entities to revalue their liabilities. The most important change was in the use of a lower discount rate, which is used to calculate the present value of future liabilities. Even a 1% decrease in this rate can result in a multibillion dollar increase in the liability. However, many reporting entities found ways to circumvent the change in their discount rate, mainly by assuming that their pensions won't run out of assets, despite enormous underfunding. New Jersey actually adopted GASB 67 in full and significantly lowered the discount rates for their pension plans, resulting in the drastic increase in their pension liabilities,” said Cruce.[7]

We also wondered how much of New Jersey’s tax burden should be attributed to the governor’s office. When we asked Bergman, he told us, “elected officials are part of that answer. But a complete answer would include the media, as well as citizens in general. You shall reap what you shall sow, the saying goes, and citizens in NJ and other challenged jurisdictions (including Chicago and Illinois) are now seeing the 'fruits' of their 'due diligence.'”[4] Cruce, who declined to comment directly on who he thinks is to blame for New Jersey’s number one ranking, added that New Jersey has been in the upper rankings since TIA’s first “Financial State of the States” study in 2009. “While the recent increase in the taxpayer burden was mainly due to the change in accounting standards, the retirement obligations have been largely underfunded for years. As stated earlier, their taxpayer burden hovered around the mid $30,000s from 2009 to 2013 and that's nothing to be proud of,” said Cruce.[7]

A third question we had is whether or not it is a problem that Conservative Solutions’ ad used the phrase “tax burden” while TIA’s preferred terminology is "taxpayer burden"? We argue that it is not. The terminology is very similar, and the ad referred to an Associated Press article that used the phrase tax burden instead of taxpayer burden. Technically, then, AP made the original error, while the ad perpetuated it.

With that being said, there is a nonprofit organization called the Tax Foundation that publishes an annual study titled the “Annual State-Local Tax Burden Ranking.” The Tax Foundation’s most recent study was released in April 2014 and covers fiscal year 2011. “Tax burden,” in this study, refers to “the amount of state and local taxes paid by state residents to both their own and other government” divided by “each state’s total income.” According to the Tax Foundation, the number that emerges from this equation shows us the “percentage of state income residents are paying in state and local taxes.”[8]

Where does New Jersey fall on the Tax Foundation’s tax burden rankings? With a 12.3 percent tax burden, it comes in at number two, just a hair behind New York’s 12.6 percent and slightly above Connecticut’s 11.9 percent. The full study can be read here. For our readers interested in learning about the methodological differences between how TIA calculates taxpayer burden and how the Tax Foundation calculates tax burden, Bergman sent us an article that he wrote for the magazine Governing in 2011.

Conclusion

A recent television ad released by a pro-Marco Rubio super PAC took aim at Chris Christie by claiming, “New Jersey has the nation’s highest tax burden.” According to a study by Truth in Accounting, that claim checks out. New Jersey’s taxpayer burden, defined as the amount of state debt for which a state’s taxpayers are on the line, topped TIA’s most recent rankings with $52,300 per taxpayer.

Launched in October 2015 and active through October 2018, Fact Check by Ballotpedia examined claims made by elected officials, political appointees, and political candidates at the federal, state, and local levels. We evaluated claims made by politicians of all backgrounds and affiliations, subjecting them to the same objective and neutral examination process. As of 2025, Ballotpedia staff periodically review these articles to revaluate and reaffirm our conclusions. Please email us with questions, comments, or concerns about these articles. To learn more about fact-checking, click here.

Sources and Notes

- ↑ Politico, "Pro-Rubio super PAC aims attack ads at Christie," January 4, 2016

- ↑ NorthJersey.com, "Survey says New Jersey has highest tax burden," September 21, 2015

- ↑ 3.0 3.1 Truth in Accounting, "Financial State of the States," September 2015

- ↑ 4.0 4.1 4.2 Email exchange with Bill Bergman on January 5, 2016

- ↑ State Data Lab, "Complimentary Downloads," accessed January 6, 2016

- ↑ State Budget Solutions, "State Budget Solutions' Fourth Annual State Debt Report," January 8, 2014

- ↑ 7.0 7.1 Email exchange with Shawn Cruce on January 5, 2016

- ↑ Tax Foundation, "Annual State-Local Tax Burden Rankings, FY 2011," April 2014

Contact

More from Fact Check by Ballotpedia

| Rob Portman on Ted Strickland's economic record January 5, 2016 |

| What state has the most veterans? December 30, 2015 |

| On Jim Justice's political contributions December 24, 2015 |

Follow us on Facebook and Twitter